What is DORA and how will it affect me?

The Digital Finance Strategy is a European directive that aims to support and develop digital finance in Europe while maintaining financial stability and consumer protection. There are three main components to the package:

- Digital Operational Resilience Act (DORA)

- Markets in Crypto-assets (MiCA) Regulation

- A proposal on Distributed Ledger Technology (DLT)

In this blog post, we’ll summarize the key parts of the DORA proposal, highlighting how it will apply to incident management at financial entities.

Side note: we also wrote a blog post about the other DORA, also known as the DevOps Research and Assessments.

What is DORA?

The proposed Digital Operational Resilience Act (DORA) was published by the European Commission to address the ever-increasing information and communications technology (ICT) risks inherent in the financial services sector. It aims to mitigate risks by enforcing a framework for operational resilience. More specifically, DORA aims to:

- Introduce better ICT risk management and governance

- Improve incident reporting (and information sharing)

- Ensure strategies exist for managing ICT third-party risk

- Implement "resilience" assessments (e.g. tests, methodologies, tools)

To frame why this is important, the European Commission estimates the cost of incidents in the EU financial sector to be up to €27 billion per year.

Will this apply to me?

The answer is likely yes if you operate in the financial services sector.

DORA will apply to various financial entities, including credit institutions, electronic money institutions, investment firms, insurance undertakings, and reinsurance undertakings.

It will also apply to firms operating in the financial services that fall under "critical ICT third-party service providers" (e.g. cloud resources, data analytics, and audit).

DORA is expected to be published at the end of 2022, although no confirmed date exists.

Impact on incident management

Let’s dive into the two key chapters (Chapters 2 and 3) from the proposal and break down what they mean in the context of incident management.

ICT risk management

Chapter 2 details changes to ICT risk management processes. In summary, it asks financial institutions to:

- Increase the involvement of senior management in ICT-related incidents

- Identify business functions that are potential sources of ICT-related incidents

- Implement strategies and policies to ensure adequate protection of ICT systems

- Establish measures to bring ICT systems back online

- Communicate ICT-related incidents to clients, financial entities, and the public

The most relevant article (Article 10) clearly defines the proposed response and recovery requirements. More specifically, it highlights the importance of recording, responding, and communicating all incidents within the organization.

Financial entities shall implement the ICT Business Continuity Policy referred to in paragraph 1 through dedicated, appropriate and documented arrangements, plans, procedures and mechanisms aimed at:

- recording all ICT-related incidents;

- ensuring the continuity of the financial entity's critical functions;

- quickly, appropriately and effectively responding to and resolving all ICT-related incidents [...];

- [...] as well as tailored response and recovery procedures established in accordance with Article 11;

- estimating preliminary impacts, damages and losses;

- setting out communication and crisis management actions [...] to all relevant internal staff and external stakeholders[...] and reported to competent authorities [...].

These core principles extend beyond responding to an incident and include frameworks for the post-incident learning process (such as post-mortems). The motivation is that with an increased focus on analyzing root causes, financial entities will reduce the likelihood and severity of similar incidents going forwards.

Financial entities shall put in place post ICT-related incident reviews after significant ICT disruptions of their core activities, analysing the causes of disruption and identifying required improvements to the ICT operations or within the ICT Business Continuity Policy referred to in Article 10.

Finally, DORA sets the expectation that senior management is involved with incident management. They will be required to report on incidents every year. In other words, the proposal highlights the need for accessible tooling for the entire organization (and not just SREs), allowing more parties to participate in the response process.

Senior ICT staff shall report at least yearly to the management body on the findings referred to in paragraph 3 and put forward recommendations.

ICT-related incidents - management, classification and reporting

Chapter 3 gives tactical information on how the incident response process should be structured and covers topics such as classification and reporting. It details how financial intuitions should:

- Establish and apply incident management processes to identify, track, log, and categorize incidents

- Ensure incidents are classified according to shared criteria

- Report major ICT-related incidents to the competent authority using a harmonized report framework

The most important article in this chapter (Article 15) outlines the critical functions of the incident management process, building on the high-level framework in Chapter 2. Essential requirements include priority and severity, role assignment, and communication plans.

The ICT-related incident management process referred to in paragraph 1 shall:

- establish procedures to identify, track, log, categorise and classify ICT-related incidents according to their priority and to the severity and criticality of the services impacted [...];

- assign roles and responsibilities that need to be activated for different ICT-related incident types and scenarios;

- set out plans for communication to staff, external stakeholders and media [...];

- ensure that major ICT-related incidents are reported to relevant senior management [...] explaining the impact, response and additional controls to be established [...];

- establish ICT-related incident response procedures to mitigate impacts and ensure that services becomes operational and secure in a timely manner.

More specifically, DORA asks for very detailed information for the classification of incidents. The criteria heavily focus on capturing the impact (number of customers, financial implications) and severity.

Financial entities shall classify ICT-related incidents and shall determine their impact based on the following criteria:

- the number of users or financial counterparts affected by the disruption caused by the ICT-related incident, and whether the ICT-related incident has caused reputational impact;

- the duration of the ICT-related incident, including service downtime;

- the geographical spread with regard to the areas affected by the ICT-related incident [...];

- the data losses that the ICT-related incident entails [...];

- the severity of the impact [...] on the financial entity's ICT systems;

- the criticality of the services affected [...];

- the economic impact [...] in both absolute and relative terms.

There is an increased requirement for reporting incidents. Not only should this happen within incident teams, but incidents that fall under specific criteria should be reported to the relevant authority. There will be a standardized format for these reports, which aims to decrease administrative overheads (for the competent authority) whilst increasing cross-entity learnings by capturing and analyzing common themes.

Financial entities shall submit to the competent authority as referred to in Article 41: [an initial notification, an intermediate report, and a final report].

What happens if I'm not compliant?

The repercussions of not complying with the proposed changes are significant. At the extreme, this can result in temporary or permanent cessation of any practice or conduct that the authority considers necessary to prevent a repetition of the incident. Competent authorities will have supervisory, investigatory, and sanctioning powers.

For third-party ICT suppliers, DORA states that it could impose a non-compliance fine of up to 1% of daily worldwide turnover for no more than six months.

How does incident.io help?

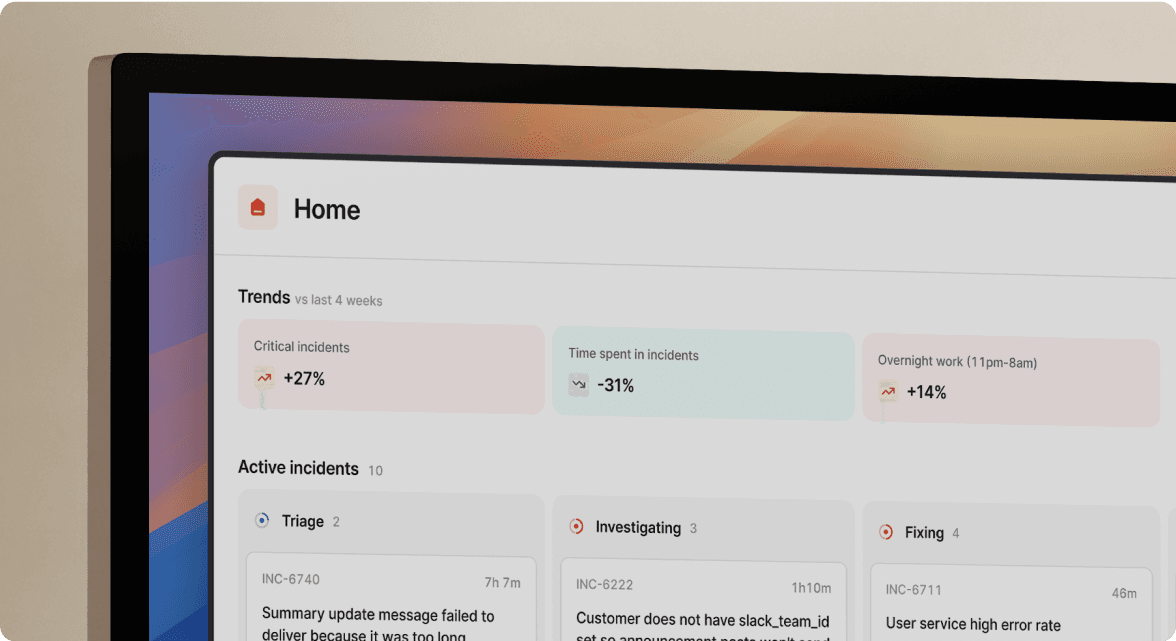

incident.io is a tool for managing all of your incidents. It's designed to be used across business functions. An incident can be quickly declared (by anyone, not just those with specialist knowledge!), decreasing the chance that things go unnoticed. incident.io encodes best practices into your communication tools, allowing you to keep internal parties updated via Slack and external parties updated via integrations with shortcuts to tools such as Status pages (and more). You can also track actions and follow-ups as you're responding to ensure nothing gets missed.

Several features are particularly applicable to the DORA proposal:

- Insights let you explore incident data in several ways: a dashboard in your browser, a data export, or via a live API connection. By capturing this information in a single database, it's easier to analyze changes over time.

- Decision Flows allow you to encode Q&A flows into your incident response process. An incident responder can answer questions like “how many customers does this impact”, “what is the expected financial impact of this incident”, or any other necessary details and be told who they need to report to or other due diligence that may be necessary to comply with regulations.

- Workflows give you the ability to automate common processes based on specific triggers. Ship an email to a regulator when an incident is triggered, get reminded to share an intermediate report when an incident reaches are certain status or get a gentle nudge to write your post-mortem when the incident is closed - all possible with Workflows!

- Post-mortems can be created in 2-clicks, customized to include valuable information from the incident channel, and configured to match your required reporting formats.

Conclusion

DORA will significantly change how financial services are required to operate their incident management processes. From asking senior management to be more involved to ensuring that a plan exists for mitigating and responding to ICT-related incidents, DORA toughens the requirements for how financial entities must respond when things go wrong. More specifically, the ask is to supercharge processes for identifying, tracking, logging, categorizing, and reporting incidents to the relevant regulators.

At incident.io, we believe in operational excellence and organizational resilience. These changes allow many financial organizations to review and improve their existing procedures, and we're here to help!

See related articles

Keeping it boring: the incident.io technology stack

This is the story of how incident.io keeps its technology stack intentionally boring, scaling to thousands of customers with a lean platform team by relying on managed GCP services and a small set of well-chosen tools.

Matthew Barrington

Matthew Barrington

Secure access at the speed of incident response

Blog about combining incident.io's incident context with Apono's dynamic provisioning, the new integration ensures secure, just-in-time access for on-call engineers, thereby speeding up incident response and enhancing security.

Brian Hanson

Brian Hanson

Everything you need to know about ITIL 5, AI and incident management

We break down ITIL 5's governance framework and what it means for teams using AI in incident response. For incident management, it addresses questions like: Who's accountable when an AI-suggested remediation backfires? How do you audit AI-generated updates?

Chris Evans

Chris EvansSo good, you’ll break things on purpose

Ready for modern incident management? Book a call with one of our experts today.

We’d love to talk to you about

- All-in-one incident management

- Our unmatched speed of deployment

- Why we’re loved by users and easily adopted

- How we work for the whole organization